When a lender asks for a letter of explanation, there’s no need to panic — more than likely the lender just needs your help to clear up, in writing, something about your credit, earnings or assets. Knowing how to write a letter of explanation (or LOE for short) may even help you avoid a loan denial or a delayed loan closing.

On this page

A letter of explanation is a written, signed and dated document you prepare to address questions a mortgage lender may have about your loan application. A loan processor or underwriter may request a letter of explanation to strengthen the case for approving your loan application and to provide evidence that your financial profile meets their minimum mortgage requirements.

Federal regulations require that lenders prove they have verified your ability to repay the loans they make. A letter of explanation may provide the extra documentation needed to:

You’ll need a letter of explanation if an underwriter doesn’t understand information on your mortgage application, or needs additional details to make a final decision about approving your loan. Here are common reasons lenders ask for LOEs.

Late payments, collections and major derogatory credit problems like foreclosures or bankruptcies almost always require a letter of explanation. Underwriters look at how you’ve managed credit in the past to determine if you’ll be able to afford a new loan.

Most loan programs require a two-year employment history without gaps between jobs. A large gap may be a red flag to a lender that your income could be unstable, when in reality you may have taken time off due to a personal illness or that of a close relative. If you’ve changed careers, a lender may ask you to explain if you’ve received any training or experience before the switch to make sure your earnings prospects are steady.

Lenders may ask for proof your employer allows you to work remotely if you’re moving to a different city or state from where your company is headquartered. Your employer should use the same format detailed below if the lender requests an LOE directly from them.

If there’s a difference between the addresses on your driver’s license, loan application and credit report, the lender will ask for a letter to clear up the discrepancies.

Underwriters scrutinize how stable your income is, and big increases or decreases in your income could result in a letter of explanation request. If you’re self-employed with complicated tax returns, you might even need to request a letter from your tax professional to help the lender understand how you’re paid.

Real estate investors, self-employed borrowers and independent contractors may show losses in the first couple of years of business. Because of this, the lender may require explanations to confirm the losses aren’t likely to continue.

Transferring large sums of money (more than 50% of your normal monthly income) between bank accounts, or depositing gift money from a relative for a down payment, could require an LOE. Lenders may also ask for additional documentation to confirm where the deposited money came from. If you pay child support or alimony, the lender may request copies of your divorce paperwork if the withdrawals come out of your bank statements but don’t appear on your credit report.

A credit inquiry tells a lender you may have opened a new credit account, which could affect the mortgage amount you qualify for. You’ll also need proof of the new account balance and monthly payment if you open new credit that doesn’t yet appear on your credit report. Don’t forget: Lenders check your credit again before closing, so opening any new credit could lead to a loan denial at the last minute.

A cosigned student loan, car loan or mortgage will require an explanation and possibly proof that you don’t make the payments.

If you have the name of a child or parent on your bank statements, lenders may ask you to explain who they are, and even ask them to provide a letter confirming you have access to all the funds in the account. You’ll need a gift letter that explains how you’re related to anyone giving you money toward your down payment, closing costs or mortgage reserves.

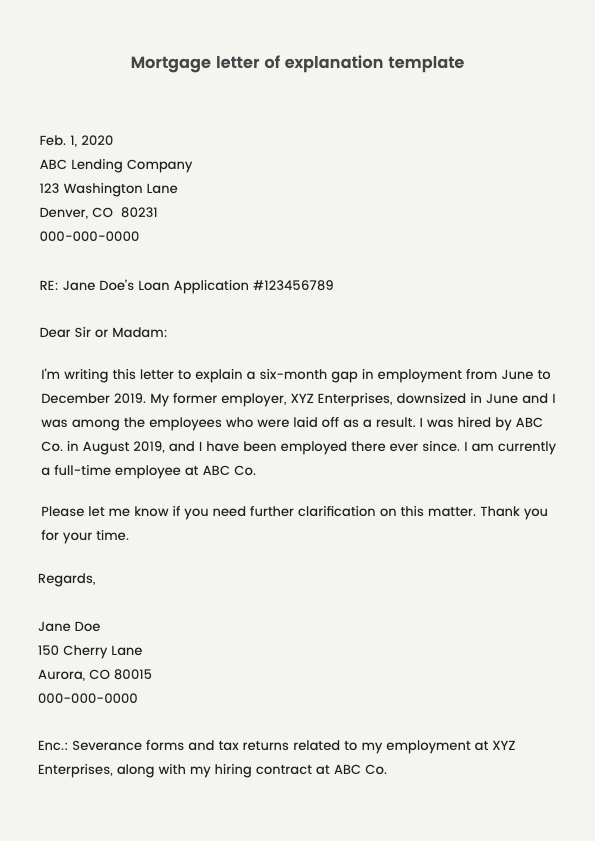

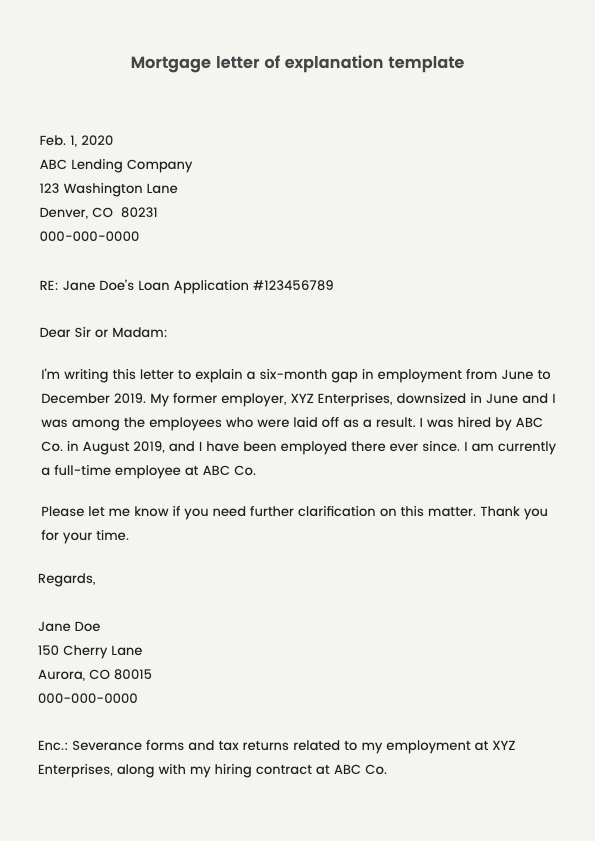

Use the following checklist as your explanation letter format:

There are a few guidelines that apply to writing a consumer explanation letter, regardless of the situation.

1. Keep it short and to the point.

The mortgage underwriter is looking for clarification on a specific issue, so stick to that topic. Provide a direct answer and don’t bring up other issues that could sow new seeds of doubt. Your goal is to prove you’re capable of taking on this loan and correcting past mistakes.

2. Emphasize the circumstances that led to the issue.

Be sure to explain the causes of any financial difficulties that led to credit problems or gaps in employment.

3. Explain how your finances have improved.

Provide details about how circumstances have changed and why they’re unlikely to occur again. Underwriters want reassurance that you’re ready to take on new debt, especially if you had trouble paying prior debts.

4. Proofread your letter.

Spelling and grammar errors can make your LOE seem less professional. Double-check to make sure the information is correct to avoid additional delays. A typo in the loan number, or accidentally using a nickname instead of your full name, could result in another explanation letter request.

5. Be nice.

Even if you’re irritated and stressed out by the request for an LOE, the tone of your letter should be polite and professional. The underwriter is simply making sure you can afford the loan you applied for. The more helpful, respectful and prompt you are with your response, the easier it will be to process your loan.

Use the explanation letter sample below as a guide for your LOE:

A rejected letter of explanation could mean it’s time to start over with a new lender or switch to a more flexible loan program (such as an FHA loan). In other cases, you may just need to provide additional explanation.

Not necessarily. Some explanations are always required — such as inquiry letter requests or address discrepancies. In other cases, the underwriter just needs additional assurance that you can afford the loan before they approve it.

In some cases, you may need to add financial documents to support your letter. For example, if you had a bankruptcy, you may need bankruptcy paperwork along with your LOE.